Al-flash array vendor Pure Storage grew revenues at a steady clip in its fourth fiscal 2024 quarter as it went past the $3 billion/year level for the first time, and previewed go-faster product for AI training.

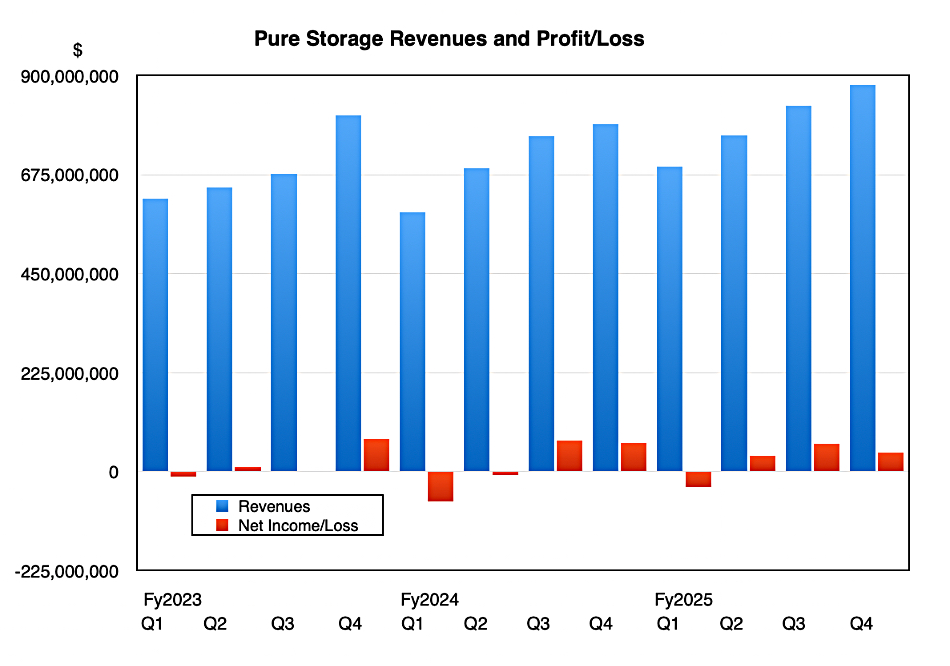

Revenues in the quarter ended February 2, 2025, were up 11 percent year/year to $879.8 million, beating guidance, with a GAAP profit of $42.4 million, 35 percent down Y/Y, and its third consecutive profitable quarter. Full fy2025 revenues were $3.2 billion, again beating its forecast, and up 12 percent Y/Y, with a $106.7 million profit, up 74 percent Y/Y.

CEO Charlie Giancarlo stated: “We delivered a solid Q4, exceeding both revenue and earnings guidance.” There were record Q4 sales for FlashBlade, FlashArray//XL, Portworx, the FlashArray//E family, and Evergreen subscription renewals. Pure returned $192 million to shareholders and announced a new $250 million share repurchase program.

Pure CFO Kevan Krysler said: “US revenue of $619 million was the primary driver of growth, while international revenue reached $261 million, down 3 percent year-over-year.”

Overall, Krysler said: “It was a pivotal year marked by industry-leading innovation, setting the stage for sustainable long-term growth.”

Quarterly financial summary:

- Gross margin: 67.5 percent, down from 71.9 percent a year ago

- Free cash flow: $151.9 million vs $200.9 million a year ago

- Operating cash flow: $208 million vs $244.4 million a year ago

- Total cash, cash equivalents, and marketable securities: $1.5billion flat Y/Y

- Remaining Performance Obligations: $2.6 billion, up 14 percent year-on-year

The gross margin decline was due to NAND price increases affecting the capaciy-optimized FlashBlade//E as it competes with disk-drive-based arrays. Basically Pure had to suck up the cost increase to maintain its competitive position. Giancarlo said: “As we indicated many quarters ago, we were going to be aggressive with the E family given that we’re really the only player in the market right now that can compete with disk and we want to take advantage of that. So we are being aggressive there.”

He reported some more nice numbers, with 62 percent of the Fortune 500 now customers, up from 60 percent a year ago, and a total customer count of >13,500; there were 334 new customers stepping aboard in the quarter.

Subscription ARR grew 21 percent to $1.7 billion. Product sales rose just 7.4 percent to $495 million.

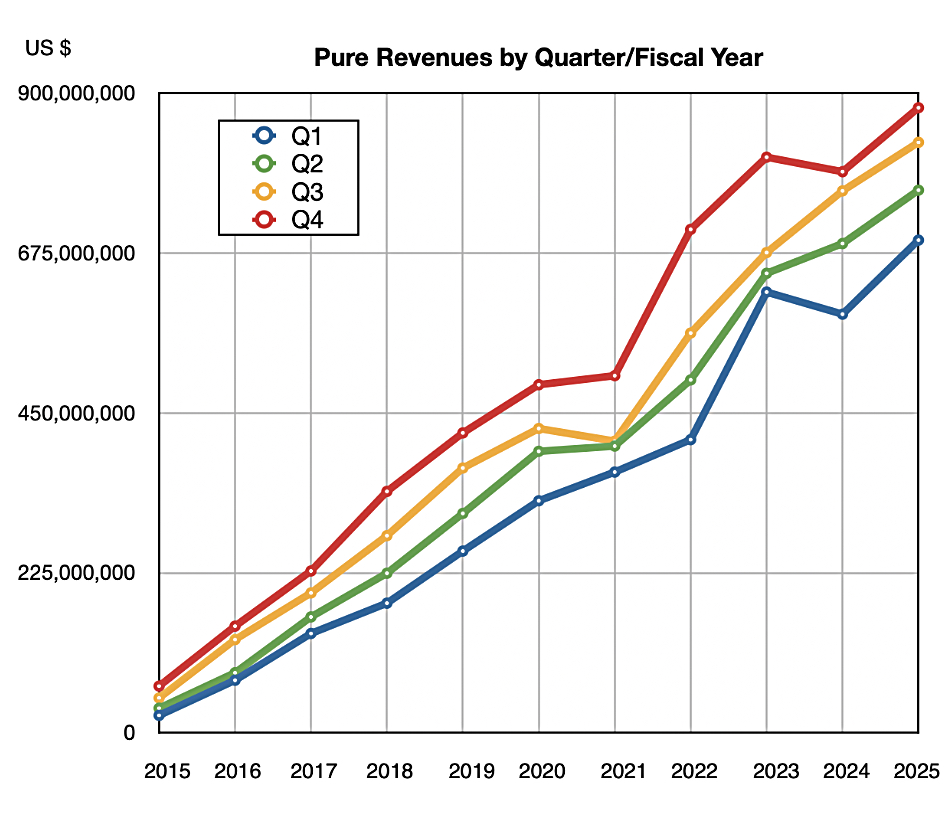

A revenue history chart shows a seasonal pattern emerging, with neatly stepped up revenue quarters throughout a fiscal year, as Pure transitions to become a consistently growing revenue machine after growth blips in fy2021 and fy2024, as a chart of sequential revenues by fiscal year shows;

With reference to Pure’s recent hyperscaler customer win, with the hyperscaler moving from disk-based storage to Pure flash-based storage, Giancarlo said in the earnings call: “The conversation continues to evolve and to expand frankly, in terms of the use cases for different types of data storage tiers inside that hyperscaler,” with “discussions around future states and where that storage will go.” Pure sees large production and deployment starting in its fiscal 2027.

CTO Rob Lee said Pure is working on ensuring its Purity SW works with the hyperscaler’s developing code and HW architectures, and that: “We are working now on multiple different performance tiers. Each one of them requires its own set of tuning. And of course, we have to also qualify several different scales of our DirectFlash modules along with several different … flash manufacturers for those DirectFlash modules.” It’s accelerating its Direct Flash module density increase road map as well.

He also said: “The discussions and engagements we are having with other hyperscalers are definitely moving forward with a faster pace.”

Giancarlo said forthcoming AI training and FlashBlade advancements will feature at NVIDIA’s GPU Technology Conference in March: “we’ve got a nice new announcement coming that we’ll be demonstrating at GTC. That really does relate to the largest scale of the AI opportunities.”

Also: “Flashblade will set a new bar for unmatched performance, scalability, and ease of deployment for large-scale AI infrastructure deployments.” Answering an analyst’s question he added this: “We’ve been able to make some modifications to our product that really allows it to address a lot of the performance characteristics that HPC environments are specifically looking for.”

Giancarlo thinks Pure’s biggest opportunity lies in customers reorganizing the way they manage “their production data from data silos into an enterprise data cloud,” with customer AI uptake causing customers rethinking their storage architecture. The aim will be for: ”AI getting access to data for real time analysis, especially in inference and RAG type environments.”

The outlook for the next quarter is $770 million in revenues an 11 percent increase again; consistency seems to be ruling here. The full fiscal 2026 revenue outlook is $3.51 billion; an increase of, yes, you guessed it, 11 percent. And Pure says, in a nod to President Trump’s tariff change suggestions, it has “developed contingency plans for a variety of tariff scenarios.“