Data storage supplier and protector Quantum reported a revenue upturn in its third fiscal quarter of 2025 and a massive loss as it clears the books and looks ahead.

For the three months ended December 31, Quantum recorded a one percent rise in revenue to $72.6 million and a $71.4 million net loss. The bulk of that loss was due to a non-cash adjustment of $61.6 million to the fair market value of warrant liabilities. Take that away and the loss was a more acceptable $9.8 million, slightly worse than the year-ago $9.4 million loss. We’ll look at warrant liabilities in a moment.

CEO Jamie Lerner stated: “Third quarter revenue increased sequentially and was above the midpoint of guidance as recent bookings momentum and customer wins were converted into realized sales.”

The revenue rise was led by higher DXi deduplicating backup appliance sales, offset by supply chain hiccups.

In sales pitch mode, Lerner said of the hardware: “Dell does not have all-flash Data Domain products. IBM does not have all-flash deduplication products. Hitachi does not have that. NetApp does not have that. There just are no major storage vendors that have that technology available today. I assume they will chase us, but they don’t have it today. Certainly, smaller vendors like an ExaGrid don’t have anything like that today. And we are just taking share with that technology.”

He claimed: “Pure Storage would say, sure, you can back up against us, and they have an all-flash appliance that is 3x to 4x more expensive than any of us operate in the backup space, and they don’t have anywhere near the efficacy of deduplication that a product like a variable length deduplication algorithm like DXi has.”

Quantum reported $20.6 million in cash, cash equivalents, and restricted cash, compared to $24.5 million a year ago. Net debt was $133 million. Gross margin was 43.8 percent, better than the year-ago 40.6 percent. Lerner talked about Quantum having “generated improving free cash flow” and “a significant reduction in operating expenses,” down 6 percent annually.

The switch to subscription sales is progressing with annual recurring revenue (ARR) of $141 million, in which subscription ARR rose 29 percent annually to $21.3 million. Over 90 percent of new product unit sales were subscription-based.

Lerner mentioned the recent SEPA deal, saying: “This quarter represented tangible evidence of improved financial performance from our ongoing business transformation and operational efficiency initiatives over the past year.”

CFO Ken Gianella added that the SEPA deal with Yorkville Advisors “gives Quantum the right to access additional capital at the company’s discretion over a three-year period.”

Warrant liabilities refer to warrant holders with the right to buy Quantum’s stock at a fixed price before the warrant expires, and with terms that specify a fair value re-evaluation in reporting periods. The warrant holders may issue cash to a company in return for the warrants. In Lerner’s view: “This is just a tool at our disposal to give us some … growth capital as well as pay down debt,” and allow Quantum to meet growth objectives. The company pays “millions of dollars of interest … per quarter.”

Gianella said in the earnings call that a $61.6 million charge resulted “from the significant increase in our stock price during the quarter as well as a positive non-cash impact of $1.2 million inter-company foreign currency adjustment.” Quantum’s stock price was $3.2 at the start of the quarter but finished at $53.92.

In Lerner’s view, this quarter has seen Quantum “executing on improving our operational process and productivity, combined with significant steps toward being cash flow positive and moving the company forward to become debt-free.”

Answering an analyst’s question, Lerner said: ”We want to get the company to be debt-free. Secondly, we want to stop burning cash and make cash, and we are getting very close to that. We think this year we’ll cross over to where we’re no longer a cash consumer, but a cash producer.”

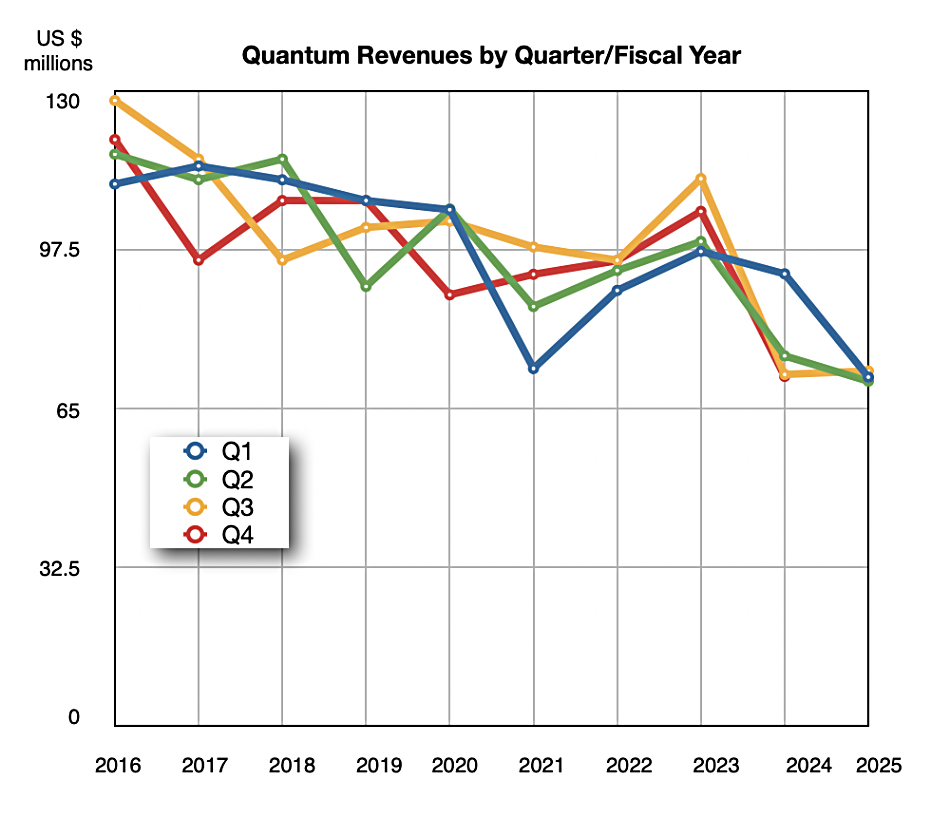

However the slight revenue growth in Q3 is unlikely to be maintained in the short-term as the outlook for Quantum’s fourth quarter is for revenues of $66 million ± $2 million; roughly 8 percent lower than the year-ago Q4, and down sequentially to a record low point for Quantum’s quarterly revenues in the last 15 years. Quantum said the decreased amount was due to seasonality and “temporary manufacturing headwinds,” particularly with the new Raptor i7 tape library. On the library, Lerner said: “This is kind of a pretty amazing new product that has 2,008 tape cartridges in a standard rack. No one has achieved anything even close to that. It is the highest and it is the largest and most dense storage appliance ever built by man. It just is.”

There’s a worry about new US import tariffs affecting its future costs as some of the components supplied by Dell and Supermicro for Quantum are made in Mexico.

Quantum promised that “efficiency gains and portfolio refresh have us poised for profitable growth into FY ’26.” Gianella said Quantum continues “to prioritize annual recurring revenue, which we expect to be a key driver for delivering increasing profitability over time.”

At the midpoint, the Q4 outlook makes for $280.4 million in revenues for the full FY 2025, down 10 percent year-on-year. Lerner commented: “We think this is the year where we’ve stemmed some of the declines in our business and we go back into growth mode.”

He added: “Our investors know that we had a very old company with old products, and we had to dig in deep with some lenders to spend the money to refresh these products, but this is the year where we are committing, and we are pretty confident that the company, because of these investments, moves into a growth mode.”