Western Digital revealed its HAMR disk technology migration plans in an Investor Day session and already has HAMR drives undergoing qualification by customers.

The Investor Day session was held to reassure investors ahead of the spin-off of the Sandisk NAND and SSD business unit expected by the end of this month. The spin-off is due to the WD stock price not reflecting the actual value of Sandisk, with the hope that an independent Sandisk will have a multi-billion dollar valuation, returning gains to current WD shareholders who will be given 0.33333 shares of Sandisk stock for each WD share they own.

The Sandisk-less Western Digital will be a hard disk drive manufacturer led by CEO Irving Tan. He and his team told investors that there will be 3x growth in generated data to 394ZB from 2023 to 2028. Over half, 59 percent, will be in enterprise data centers and the public cloud, 15 percent in edge devices (in-store controllers, substations, branch offices, etc.) and 26 percent in endpoint devices such as PCs and laptops.

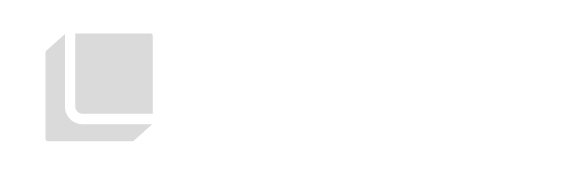

Core and Edge data centers will hold 3,043 EB in 2028, with nearline HDDS accounting for the bulk of it, as a chart indicates.

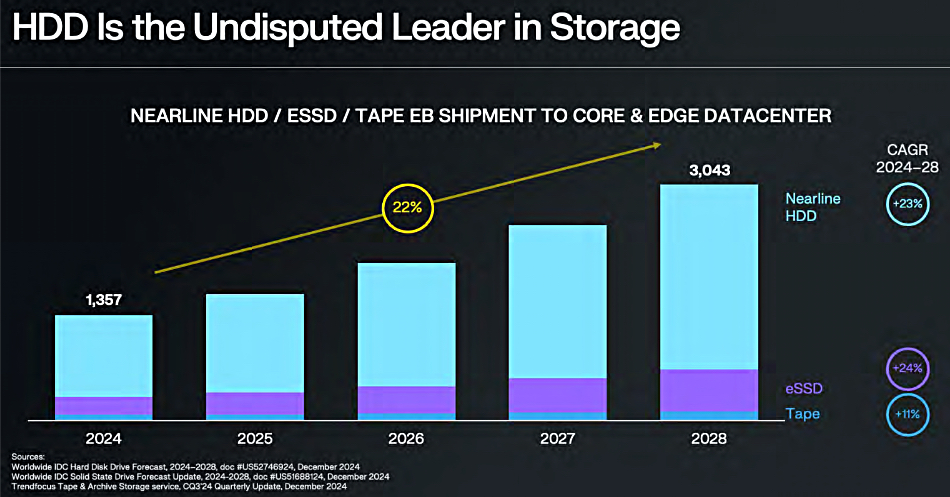

This will be because, WD says, enterprise SSDs will continue to cost 6x more per TB than nearline disk drives, and the acquisition cost is the majority of total lifetime ownership costs for SSDs and HDDs:

It says SSDs have a 3.6x greater TCO than disk drives taking acquisition, power draw and other costs into account.

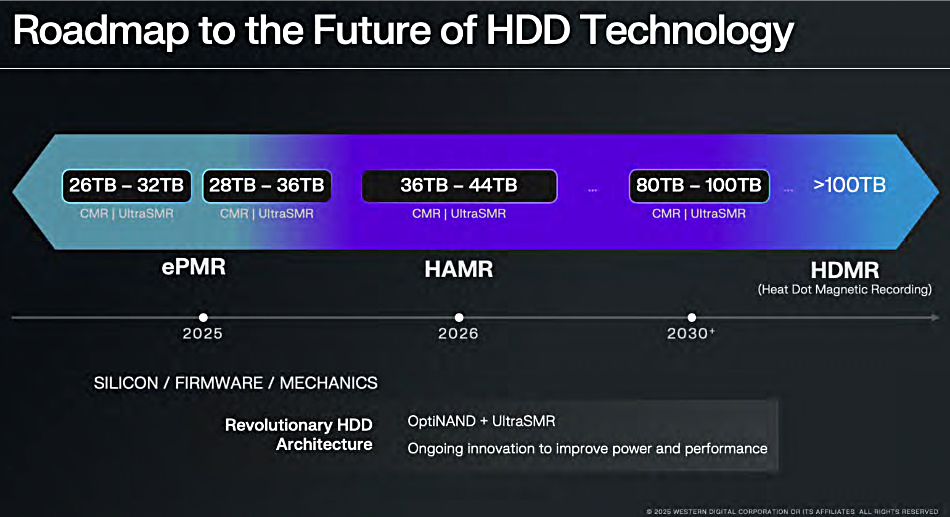

WD will ensure it plays a strong role in supplying HDDs by producing higher-capacity drives with a migration to HAMR technology. It currently ships 26TB conventional and 32TB shingled drives using ePMR recording technology with microwaves helping legacy perpendicular magnetic recording (PMR) create smaller bit areas.

But it needs 11 platters to achieve this whereas Seagate has 32TB, 10-platter shingled HAMR drives nearing general availability with 36TB in development and 40TB drives slated for later this year. This gives it an areal density and cost of goods advantage.

Consequently WD has revealed its HDD roadmap out to 2030 and beyond, with 28TB conventional and 36TB shingled drives using ePMR tech later this year. HAMR drives will appear in 2026 with 36TB conventional and 44TB TB shingled capacities in 2026. WD said it is planning to enter HAMR mass production in late 2026/2027.

It is promising 80TB conventional and 100TB shingled drives in the 2030+ timeframe with greater than 100TB drives after that, built with HDMR (Heated Dot Magnetic Recording).

It says the majority of its capital expenditure and budget is allocated to HAMR drive development and has begun hyperscaler testing of HAMR drives. Seagate found such testing took many years. We’ll see if WD can avoid that testing trap. About this Wedbush analyst Matt Bryson commented: “Getting HAMR right on the first try seems ambitious.”

You can check out WD’s Investor Day presentation here.

Bootnote

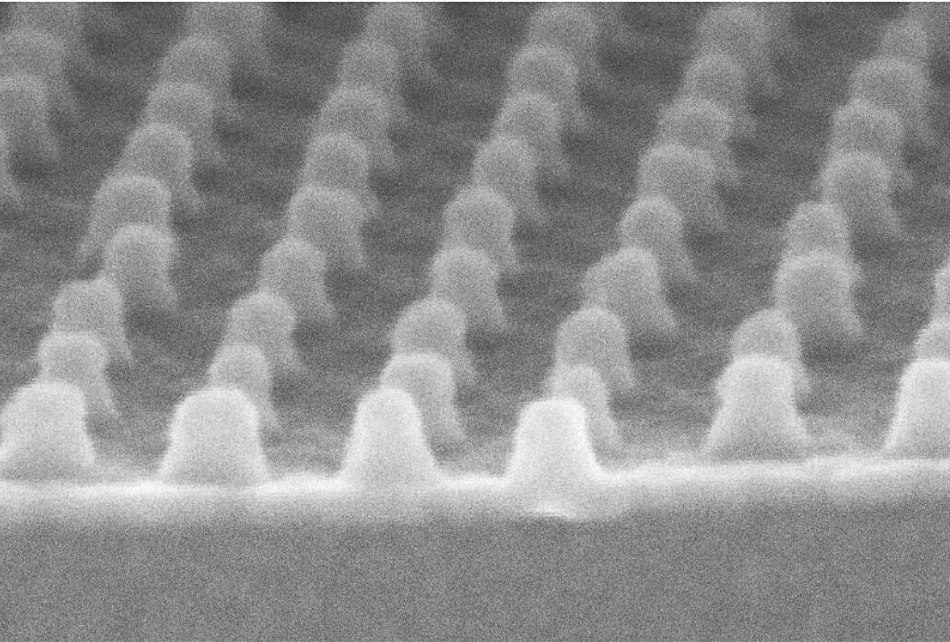

HDMR is based on ultra small, non-interacting, and thermally stable (at room temperature) magnetic dots. They are heated by laser, as with HAMR, to lower their resistance to magnetic polarity changes (coercivity) and so enable bit value writing.

HDMR can be viewed as a combination of HAMR and bit-patterned media (BPM) with one grain used per bit. With BPM there is an array of lithographically defined magnetic islands as opposed to PMR and HAMR which have a recording medium composed of a dense collection of random grains about 10nm in diameter. A recording bit is an area, hundreds of nanometers in size, a magnetic domain, containing many such grains, each of which have the same magnetic polarity.