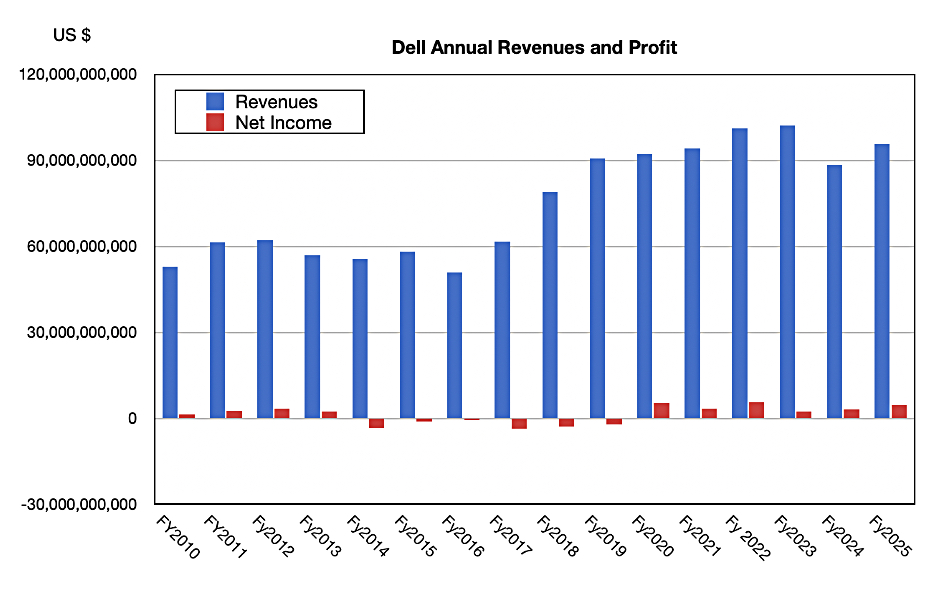

Dell reported $23.9 billion in revenue for the quarter ended January 31, 2025, up 7 percent year-over-year, with a 27 percent jump in GAAP profit to $1.53 billion. Full FY 2025 revenues were $95.6 billion, up 8 percent year-over-year, with a 36 percent leap in profit to $4.58 billion. There was record full-year and Q4 profitability.

Vice chairman and COO Jeff Clarke stated: “We grew our Infrastructure Solutions Group revenue by 22 percent, and we’re well positioned to capture growth across every segment of our business. Our prospects for AI are strong as we extend AI from the largest cloud service providers into the enterprise at scale, and out to the edge with the PC. The deals we’ve booked with xAI and others put our AI server backlog at roughly $9 billion as of today.”

CFO Yvonne McGill said: “FY 25 was a transformative year – we hit $95.6 billion in revenue, grew our core business double digits, unlocked efficiencies, and drove record EPS. We’re raising our annual dividend by 18 percent, demonstrating our commitment to shareholder return and confidence in our opportunity to grow in FY 26.” Dell also announced a $10 billion increase in share repurchase authorization.

Quarterly financial summary

- Gross margin: 23.7 percent vs 24.1 percent a year ago

- Operating cash flow: $600 million

- Free cash flow: $474 million vs $1 billion a year ago.

- Cash, cash equivalents, and restricted cash: $3.6 billion vs $7.4 billion a year ago

- Diluted EPS: $2.15, up 30 percent year-over-year

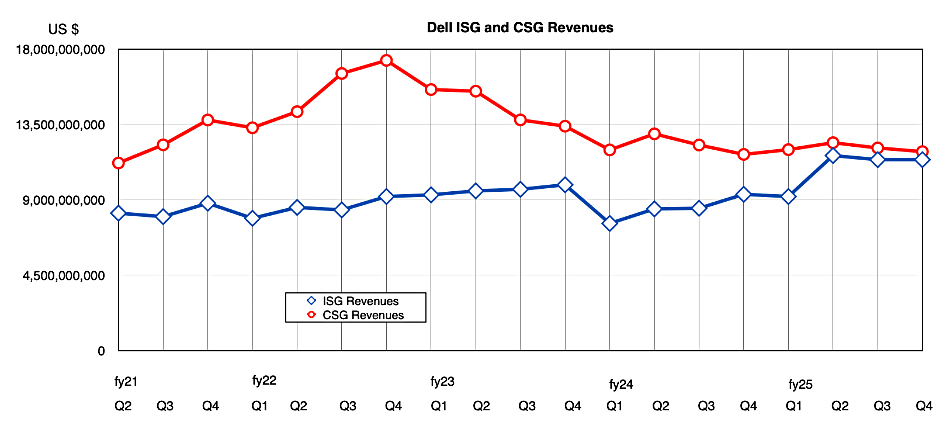

There are two Dell business units, ISG and CSG. Infrastructure Solutions Group (ISG – servers, storage and networking) revenues amounted to $11.4 billion, up 22 percent year-over-year, while Client Solutions Group (CSG – PCs and notebooks) recorded a mere 1 percent rise to $11.9 billion. Commercial CSG sales rose 5 percent year-over-year to $10 billion but consumer sales dropped 12 percent to $1.9 billion. A PC refresh cycle can’t come soon enough.

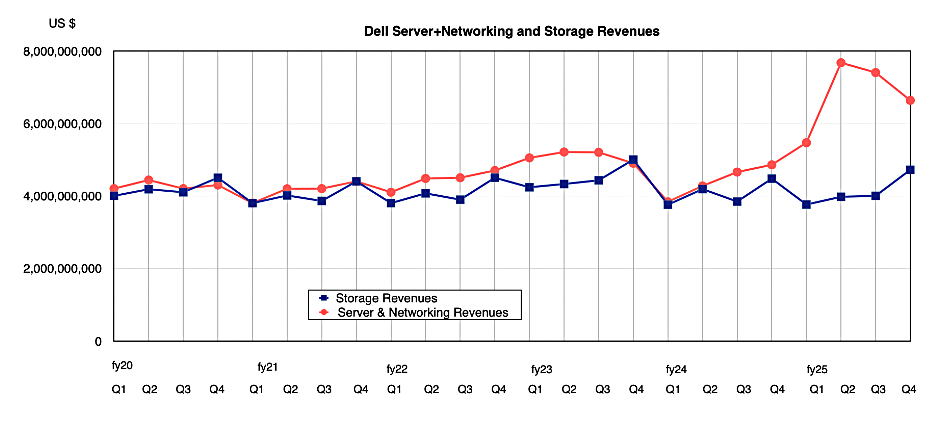

Within ISG, servers and networking revenue rose 37 percent to $6.6 billion, while storage limped along behind, growing just 5 percent to $4.7 billion. This growth rate was better than NetApp’s latest quarterly increase of 2 percent, but worse than Pure’s 11 percent.

Server sales rose sharply, but it appears storage sales held ISG back. Why? CFO McGill said: “The overall [storage] demand environment is lagging that of traditional servers,” but “we see some promising trends.”

It was, Dell said, the “second consecutive quarter of storage revenue growth at +5 percent year-over-year, with record PowerStore demand that grew double digits in the quarter.”

There was also double-digit demand growth in PowerScale (formerly Isilon) and continued growth in PowerFlex (disaggregated block + file offering) demand. PowerFlex uses Dell’s own IP and can grow from three to more than 2,000 nodes with separate compute and storage node scaling. It uses flash media with data distributed across the nodes for parallelism.

Clarke commented in the earnings call: “We are well positioned in some of the fastest-growing categories within storage as customers shift towards disaggregated architectures.”

Dell sees a strongly growing AI opportunity. There was a $4.1 billion AI order backlog exiting Q4. But in February it booked more server deals with xAI and others to lift the backlog to $9 billion. Its AI optimized server pipeline continues to expand sequentially.

Trad server demand is substantial, being up double-digits year-over-year for the fifth consecutive quarter.

Dell talked about pivoting to more of its own storage IP, gaining profitability. Clarke said: “You’re seeing a pivot to our Dell IP storage. Modern workloads demand an architecture that can be flexible, sufficient, optimizes performance. And we think a disaggregated architecture is the right answer with the modern workloads.” He’s talking about PowerFlex.

He added: “That presents a headwind of our large position that we have in HCI (hyperconverged infrastructure), which will become smaller. But we’re going to overcome that by taking share in our Dell IP storage portfolio across the board in the midrange.”

He admitted: ”There’s revenue that we’ll see go away at a lower margin rate, the HCI business. We have a secular decline in the high-end space where we’re the market leader with our PowerMax product. So we’re going to overcome those and drive the growth.”

An analyst asked about what will happen with storage as AI server sales grow. Clarke was bullish: ”AI needs data. It devours data. You got to feed the beast. The feeding of that beast … has to be closer to where the computational capability is. So hot and warm storage, the notion of parallel file systems, unstructured file systems, data management tools that help find data and help data be ingested are the opportunities.”

“We have the leading platform for unstructured data. We continue to make it better with the F910 and F710 [PowerScale systems] that I mentioned earlier. Nearly a year ago, we talked about a parallel file system that we are building, Project Lightning, we referred to it. So we’re coming to the marketplace with an AI-driven parallel file system.”

“And our Dell data lakehouse allows us to help customers prepare their information, manage their information and adjust their information. Our sales force is incented to attach storage with AI opportunities.”

The Dell execs also talked about modernizing Dell through simplification, standardization, and automation so that it can can grow while reducing operating expenditures. Clarke declared: “We are building a new company … We are modernizing the work, the workflows, taking steps out of processes, taking out manual touches, simplifying and standardizing those processes, applying automation.”

Dell is eating its own AI dogfood. Clarke said: “We are deploying AI in the enterprise. The broad categories of use cases are industry-known, whether that’s content creation and management, support assistance, natural language search, design and data creation, cogeneration or document automation. Those are broad enterprise use cases. We are deploying those types of technologies inside our company and seeing tremendous efficiency from that and it is durable. It’s not a one-timer.”

The next quarter (Q1 FY 2026) outlook is for revenues of $23 billion ± $500 million, a 3 percent rise at the midpoint. The full FY 2026 outlook is $103 billion ± $2 billion in revenues, an 8 percent rise.